Pacific World, the integrated global DMC and event management organization, released its first Annual Destination Index Special Report.

This report provides corporate, association and agency planners from all industries with a detailed insight into the most popular destinations for meetings, incentives and events as well as identifies key trends that are influencing these results.

“The Pacific World Destination Index was initially launched in March 2014, but following extended research, we are now in a position to analyze the whole year and give a full overview not just about which destinations are the most popular for meetings, incentives and events but also identify trends, top industry sectors, and the most popular markets travelling into the destinations and the respective services/products they are demanding,” commented Harsha Krishnan, strategic development director, Pacific World.

“The 12-month overview has allowed us to incorporate factors, such as seasonality by using a three-month rolling average and year-on-year comparisons, growth and group size. We also analyze the destinations on a monthly basis, looking at recent changes in country/city image; new flights and accessibility; major events; buzz about new hotels/infrastructure; political, economic and currency movements; and which event types they are seeing requests from.”

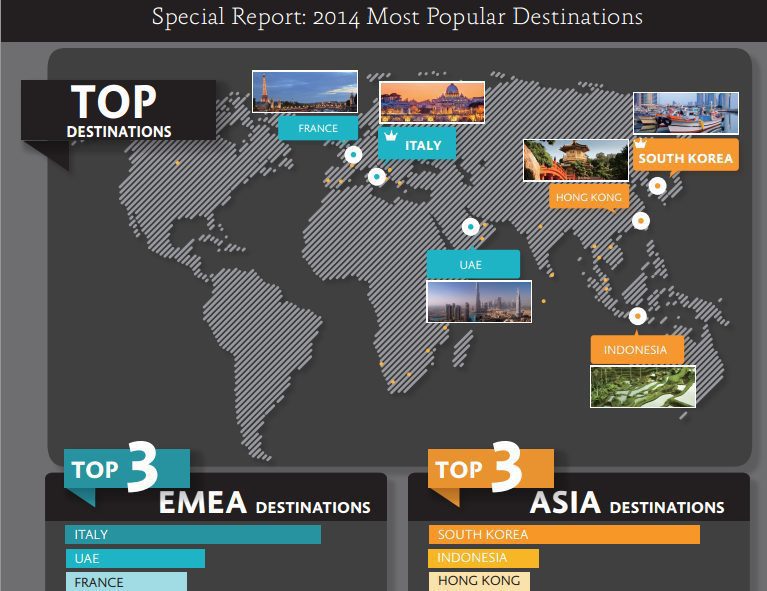

In the European, Middle Eastern and African (EMEA) region, the most popular destinations have been identified:

Rome, for its conventional but reinvented venues and activities as well as the aggressive investment in new hotels in the city (7 percent new hotels) as well as in Milan (5 percent) in the last two years.

Demand for luxury and high-end activities is back in the sector, and Dubai has a wide offering to accommodate visitors including the Dubai Tram, the Four Seasons Jumeirah, Four Seasons Jumeirah, Sheraton Grand Sheikh Zayed Road and Hyatt Regency Dubai Creek Heights.

Paris, Strasbourg and Loire Valley in France are also attracting strong number of meetings and incentive planners. Corporate company headquarters located in Paris’ outskirts including Bayer, Sanofi, Abbott, Baxter, Dell, HP, Peugeot and Renault and the holding of related corporate or investigators meetings in the capital have contributed towards the increase of corporate events and meetings.

Pacific World’s Destination Index Special Report also shows that South Korea, Indonesia and Hong Kong were the most popular meetings and events destinations in Asia in 2014.

Krishnan commented, “South Korea being identified as one of the TOP destinations has been an interesting result. Creative and well-executed promotional campaigns have helped to overcome the North Korea threat-related issues from the previous years that had drastically affected tourism. The geopolitical situation became less volatile in 2014, thereby increasing the sense of security for tourists in South Korea. The growth of the Chinese middle class and the improved visa facilities to access South Korea have also impacted the overall inbound MICE business.

“In Indonesia, Bali is the destination attracting the greatest amount of MICE business. After years of battling the negative impact of the terrorist attack in 2005, Bali is finally being perceived as a safe destination now with heightened security measures put in place by the Police and local people.

“Hong Kong has been a pleasant surprise. Despite the political situation, we have seen an increase in clients looking for suppliers offering guarantees in the areas of Corporate Governance and Compliance. The tax free system and the visa exemption for almost all visitors have also been key factors contributing toward the success of MICE business in Hong Kong.”

Top trends identified as influencing factors driving more meeting planners toward these destinations include:

- Compliances and Corporate Governance guarantees – International clients are increasingly requesting suppliers to offer guarantees in the areas of Corporate Governance and Compliance.

- Visa Policies – The immigration policies and visa requirements are still a strong a decisive factor when choosing a destination.

- Destination Reinvention – TOP destinations have been able to reinvent themselves taking advantage of the their cultural and natural heritage & investing in new/trendy/ modern structures. Ancient and new – destinations offering a combo of historic and state of the art venues and hotels are the most demanded.

- International Hotels Chains investment generating trust – The opening of new international well-known brand hotels in the destinations generates trust and interest for a destination. These investments are seen as a sign of confidence: if an international chain is investing in new hotels in a hidden city in China there must be potential and something attractive not just for the leisure but also for the MICE industry.

Krishnan concluded, “The report identifies both the short and long-term trends, which help us understand how we need to evolve our products to fit with our clients’ requirements.”

To download the Pacific World Destination Index Special Report, go to the official website.